Comprehensive auto insurance covers damage to your car from non-collision events. It includes protection against theft, fire, and natural disasters.

Accidents happen, but not all are due to collisions. Think about a fallen tree, a hailstorm, or even vandalism. These situations can lead to costly repairs. Comprehensive auto insurance ensures you are covered in these unexpected events. It’s more than just collision coverage.

It offers peace of mind when facing the unpredictable. Understanding comprehensive auto insurance can help you make informed decisions about your coverage. In this blog, we will explore what comprehensive auto insurance is and why it might be essential for your vehicle protection. Stay with us to learn more about its benefits and how it works.

Credit: www.dehayes.com

Introduction To Comprehensive Auto Insurance

Comprehensive auto insurance is a type of coverage for your vehicle. It protects against damages not caused by a collision. This includes events like theft, fire, and natural disasters.

Understanding this type of insurance can save you a lot of stress. It covers many unexpected situations. Let’s delve deeper into what makes comprehensive auto insurance important.

Basics Of Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement of your vehicle. This applies if your car is damaged by something other than a crash. Common examples include vandalism and falling objects.

Unlike liability insurance, it does not cover injuries to people. It focuses only on your vehicle’s damage. This makes it a key part of a full auto insurance policy.

Importance Of Comprehensive Insurance

Comprehensive insurance protects your financial well-being. Without it, you would pay out of pocket for many types of damage. This can be costly and stressful.

This coverage also adds peace of mind. You know your vehicle is protected from many risks. In many cases, lenders require it if you have a car loan. This ensures their investment is safe too.

Coverage Details

Comprehensive auto insurance provides extensive protection for your vehicle. Understanding the coverage details is essential. This knowledge helps you know what you’re paying for. Let’s explore the specifics.

What It Covers

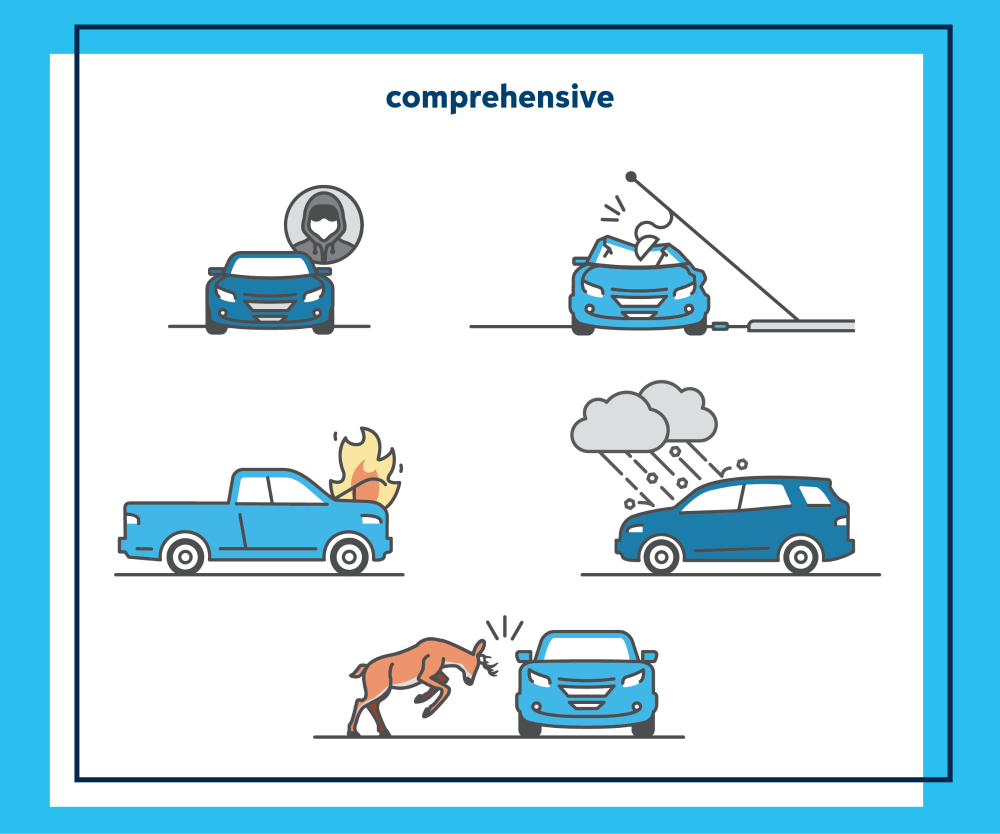

Comprehensive auto insurance covers a wide range of incidents. It protects against theft. It includes damage from natural disasters. This means events like floods and hurricanes. Fire damage is also covered. Vandalism falls under this coverage. If someone keys your car, you’re protected. Animal collisions are included. Hitting a deer? You’re covered. Falling objects like trees or rocks are part of the policy. Even civil disturbances, like riots, are covered.

What It Doesn’t Cover

There are limits to comprehensive coverage. It doesn’t cover regular wear and tear. Maintenance issues are not included. Mechanical breakdowns are excluded. Damage from a collision is not covered. This requires collision insurance. Personal belongings in the car are not covered. Health expenses from an accident are excluded. Damage due to racing or intentional harm is not included. Always check your policy for full details.

Comparing Comprehensive And Collision Insurance

Understanding the difference between comprehensive and collision insurance can save you money. It also ensures you have the right coverage for your needs. Let’s dive into the details and compare these two types of auto insurance.

Key Differences

Comprehensive insurance covers damages not caused by a collision. These include theft, fire, vandalism, and natural disasters. It also covers damage from falling objects, animals, and weather events.

Collision insurance covers damages to your car from a collision. This includes accidents with other vehicles or objects like fences and trees. It does not cover non-collision related damages.

Here’s a table to summarize the key differences:

| Aspect | Comprehensive Insurance | Collision Insurance |

|---|---|---|

| Coverage Type | Non-collision damages | Collision damages |

| Examples of Coverage | Theft, fire, vandalism | Accidents with vehicles, objects |

| Typical Scenarios | Natural disasters, animal collisions | Car accidents, hitting a tree |

When To Choose Which

Choose comprehensive insurance if you live in an area prone to natural disasters. It’s also useful if your car is at risk of theft or vandalism.

Opt for collision insurance if you drive often and want to protect against accident damages. It’s especially important if you have a newer or more expensive car.

Here’s a quick guide to help you decide:

- If you have an old car, comprehensive might not be worth it.

- If you park on the street, comprehensive can be helpful.

- If you have a loan, your lender might require both.

Both types of insurance have their benefits. Evaluate your situation to make the best choice.

Factors Affecting Premiums

Comprehensive auto insurance covers various types of damage to your car. These damages include theft, fire, and natural disasters. It is important to understand what affects your premiums. Your premium is the amount you pay for insurance. Various factors influence this cost.

Vehicle Type

The type of vehicle you drive affects your insurance premiums. Luxury cars cost more to insure. They have expensive parts and repairs. Sports cars also have higher premiums. They are often involved in accidents. Older cars usually have lower premiums. They are cheaper to repair or replace.

Location And Usage

Your location plays a big role in your premiums. Living in a high-crime area increases your insurance costs. More theft and vandalism happen in such areas. Urban areas usually have higher premiums. There are more accidents and claims in cities.

How you use your car also matters. Driving long distances daily increases your premiums. More miles mean more wear and tear. It also means a higher chance of accidents. Using your car for business purposes can also raise your premiums. Business use often involves more driving and risk.

How To Get Comprehensive Auto Insurance

Getting comprehensive auto insurance can be crucial for protecting your vehicle. This type of insurance covers damages from non-collision incidents. It includes theft, fire, and natural disasters. Follow these steps to obtain comprehensive auto insurance.

Choosing The Right Provider

Selecting the best insurance provider is essential. Begin by researching different companies. Look for customer reviews and ratings. Make sure the provider offers comprehensive coverage. Check if they have a good claim settlement ratio. This ensures you won’t face issues during claims.

Consider the cost of premiums. Compare quotes from various providers. Use online tools to get estimates. Make a list of potential providers. This helps you narrow down your choices.

Steps In The Application Process

Once you have chosen a provider, follow these steps:

- Gather Information: Collect details about your vehicle. This includes make, model, and year. Have your driver’s license and registration ready.

- Request a Quote: Contact the provider for a quote. Provide the gathered information. They will give you an estimate based on your details.

- Review the Policy: Examine the policy terms. Look for coverage limits and exclusions. Ensure it meets your needs.

- Complete the Application: Fill out the application form. Provide accurate information. Double-check for any errors.

- Make Payment: Choose a payment plan. You can pay monthly or annually. Ensure you make timely payments to keep the policy active.

- Receive Confirmation: The provider will send you a policy document. This confirms your coverage. Keep this document safe.

Following these steps ensures you get comprehensive auto insurance. It protects your vehicle from various risks. Remember, choosing the right provider is key. Good luck with your search!

Credit: www.progressive.com

Benefits Of Comprehensive Coverage

Comprehensive auto insurance provides extensive coverage for your vehicle. It covers damages not caused by a collision. This type of insurance offers several benefits. It ensures financial stability and peace of mind.

Financial Protection

Comprehensive coverage protects against non-collision damages. It includes theft, fire, and natural disasters. This means fewer out-of-pocket expenses. You avoid high repair costs. This financial protection is crucial for unexpected events. It ensures your savings remain intact.

Peace Of Mind

Knowing your car is covered brings peace of mind. You can drive without worry. It covers various risks. This reduces stress. You feel secure on the road. No need to worry about unforeseen damages. Comprehensive coverage is a safety net. It provides confidence in your daily commute.

Common Myths And Misconceptions

Comprehensive auto insurance often comes with various myths and misconceptions. Many people misunderstand what it covers and how it works. These misunderstandings can lead to confusion and poor decisions about car insurance. Let’s clear up some common myths and misconceptions about comprehensive auto insurance.

Misunderstandings About Coverage

Many believe comprehensive insurance covers everything. This is not true. Comprehensive insurance covers specific types of damage. It does not cover collision damage. It also does not cover normal wear and tear. Knowing what is covered can help you make better decisions.

Another common myth is that comprehensive insurance is very expensive. While it can be more costly than basic coverage, it is not always unaffordable. The cost depends on various factors. These include your car’s value, your location, and your driving record. Understanding these factors can help you find affordable rates.

Clarifying Common Confusions

Some think comprehensive insurance covers medical expenses. This is not true. Comprehensive coverage focuses on non-collision incidents. Examples include theft, vandalism, and natural disasters. Medical expenses are usually covered by personal injury protection or medical payments coverage.

Many people confuse comprehensive coverage with collision coverage. Collision insurance covers damage from car accidents. Comprehensive insurance covers other types of damage. Knowing the difference helps you choose the right coverage for your needs.

Lastly, some assume their insurance will cover everything in their car. This is a misconception. Comprehensive insurance typically does not cover personal belongings. Items like laptops or mobile phones are not covered. You may need additional coverage for personal belongings.

Conclusion And Final Thoughts

Comprehensive auto insurance offers a broad range of protection for your vehicle. It covers damages from events other than collisions. Understanding its benefits can help you make an informed decision. Below, we summarize key points and provide final recommendations.

Summary Of Key Points

- Coverage Scope: Comprehensive insurance covers non-collision incidents like theft, fire, and natural disasters.

- Financial Protection: It helps with repair or replacement costs, reducing out-of-pocket expenses.

- Peace of Mind: Knowing your vehicle is protected against various risks can ease worries.

Final Recommendations

Consider your vehicle’s value and your financial situation before choosing comprehensive insurance. Here are some tips:

- Evaluate the cost of premiums versus potential repair costs.

- Assess the risk factors in your area, such as theft or weather conditions.

- Consult with an insurance agent to understand the best coverage options for you.

Investing in comprehensive auto insurance can offer significant benefits. Protect your vehicle and enjoy peace of mind on the road.

Credit: www.auto-owners.com

Frequently Asked Questions

What Does Comprehensive Auto Insurance Cover?

Comprehensive auto insurance covers damages to your vehicle from non-collision incidents. This includes theft, vandalism, natural disasters, and animal collisions.

Is Comprehensive Auto Insurance Mandatory?

Comprehensive auto insurance is not mandatory. However, it provides valuable protection against unforeseen events. Many lenders may require it for financed vehicles.

How Is Comprehensive Auto Insurance Different From Collision Insurance?

Comprehensive insurance covers non-collision damages. Collision insurance covers damages from accidents with other vehicles or objects. Both provide essential protection for your vehicle.

Does Comprehensive Insurance Cover Rental Cars?

Comprehensive insurance can cover rental cars, but it depends on your policy. Always check with your insurer for specific coverage details.

Conclusion

Comprehensive auto insurance offers valuable protection for your vehicle. It covers theft, damage, and other incidents beyond collisions. This insurance can save you from unexpected expenses. Understanding its benefits helps you make informed decisions. Always review your policy details carefully.

Choose coverage that suits your needs and budget. Protect your car and enjoy peace of mind on the road.