Car insurance costs vary based on many factors. These factors include your age, car model, and driving history.

Understanding car insurance is essential for every driver. The cost of car insurance can be confusing. Many elements affect the price you pay. Your age, driving record, and car type all play a role. Insurers also consider where you live and how much you drive.

This blog will help you understand these factors. Knowing this will help you find the best rates. We will explore the different aspects that impact car insurance costs. By the end, you will have a clear idea of what to expect when insuring your car. Let’s dive in and demystify car insurance pricing.

Factors Influencing Car Insurance Costs

Understanding the factors influencing car insurance costs can help you make informed decisions. Several elements impact the final amount you pay. Let’s explore the most significant factors.

Vehicle Type

The type of vehicle you drive affects your insurance cost. Newer cars usually cost more to insure. High-performance cars might also increase your premium. Insurance companies consider the make, model, and year of your vehicle. They evaluate repair costs and safety features. These details help insurers assess risk levels.

Driver’s Age And Experience

Your age and driving experience significantly influence your insurance rates. Young drivers often face higher premiums. Insurers see them as high-risk due to less experience. Mature drivers with a clean record usually enjoy lower rates. Long years of driving without claims can benefit you. Insurers reward safe and experienced drivers with discounts.

Credit: www.insurancebusinessmag.com

Types Of Car Insurance Coverage

Car insurance is essential for protecting yourself and your vehicle. There are different types of car insurance coverage. Each type covers different aspects. Understanding these types helps you choose the right plan.

Liability Coverage

Liability coverage is a must-have. It covers damages you cause to others. This includes both property damage and bodily injury. If you are at fault in an accident, liability coverage pays for the other party’s expenses. It does not cover your own damages. It’s required by law in most states.

Comprehensive And Collision

Comprehensive and collision coverage protect your own car. Comprehensive coverage helps with non-collision events. These include theft, fire, and natural disasters. Collision coverage pays for damages from a collision. This includes accidents with another vehicle or object.

Both types are optional but highly recommended. They provide peace of mind. With these coverages, you won’t worry about unexpected costs. They help repair or replace your car after an incident. Consider adding them to your insurance plan.

Regional Variations In Car Insurance Rates

Car insurance rates vary widely across different regions. These variations can depend on many factors including population density, state regulations, and local driving conditions. Understanding these regional differences can help you make informed decisions about your car insurance.

Urban Vs. Rural Areas

Insurance rates differ between urban and rural areas. Urban areas tend to have higher rates. This is due to more traffic, higher accident rates, and increased risk of theft. In contrast, rural areas usually have lower rates. Fewer cars on the road means fewer accidents.

| Area Type | Average Annual Rate |

|---|---|

| Urban | $1,500 |

| Rural | $1,000 |

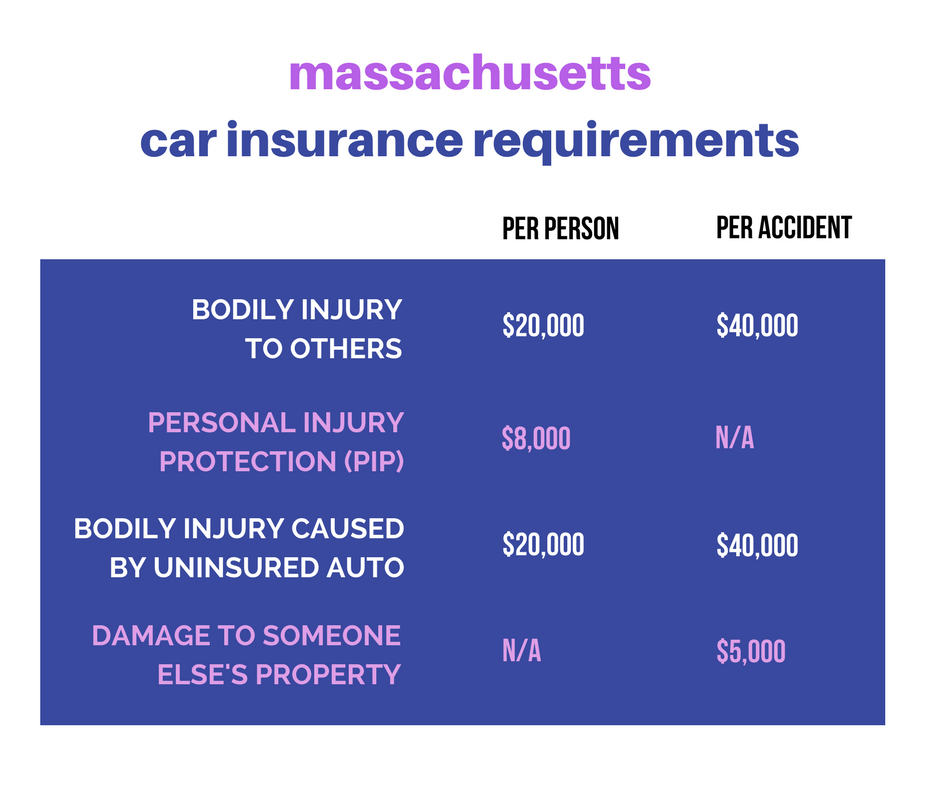

State-specific Regulations

Each state has its own insurance regulations. These rules impact rates significantly. For instance, some states require minimum liability coverage. Others may have no-fault insurance laws.

- California: Minimum liability coverage required.

- Florida: No-fault insurance laws.

- Texas: Higher liability limits.

State regulations can also affect other factors. These may include discounts, penalties, and premium calculations. Knowing your state’s regulations can help you find better rates.

In some states, drivers with clean records may get substantial discounts. In others, even minor infractions can hike premiums.

| State | Average Annual Rate |

|---|---|

| California | $1,800 |

| Florida | $2,200 |

| Texas | $1,600 |

To sum up, regional variations in car insurance rates are influenced by many factors. These include urban vs. rural settings and state-specific regulations. Being aware of these differences can help you choose the best insurance plan for your needs.

Impact Of Driving Record On Premiums

Your driving record plays a crucial role in determining car insurance premiums. Insurers use this record to assess risk. A clean driving history often means lower costs. Conversely, accidents or violations can lead to higher premiums.

Accidents And Violations

Accidents can significantly impact your insurance rates. Each incident suggests a higher risk. Insurance companies react by increasing premiums. Violations like speeding tickets also affect your costs. Frequent violations indicate risky driving behavior. This raises your insurance expenses too.

Safe Driver Discounts

A clean driving record can unlock discounts. Safe driver discounts reward careful driving. Insurers offer lower premiums to those with no accidents. Even minor violations can affect eligibility for these discounts. Consistent safe driving helps maintain these benefits.

Effect Of Credit Score On Insurance

Car insurance premiums can vary significantly. One major factor is your credit score. Insurance companies use this score to predict risk. A higher score often means lower premiums. Lower scores can result in higher costs. Understanding this can help you save money.

Credit-based Insurance Score

Insurance companies use a special credit-based insurance score. This score is different from your regular credit score. It focuses on payment history and current debt. It predicts how likely you are to file a claim. A high score suggests lower risk. This can lead to lower premiums.

Improving Your Score

Improving your credit score can lower your insurance costs. Pay your bills on time. Reduce your credit card balances. Check your credit report for errors. Dispute any mistakes you find. Avoid opening too many new accounts at once. Patience is key. Improvements can take time.

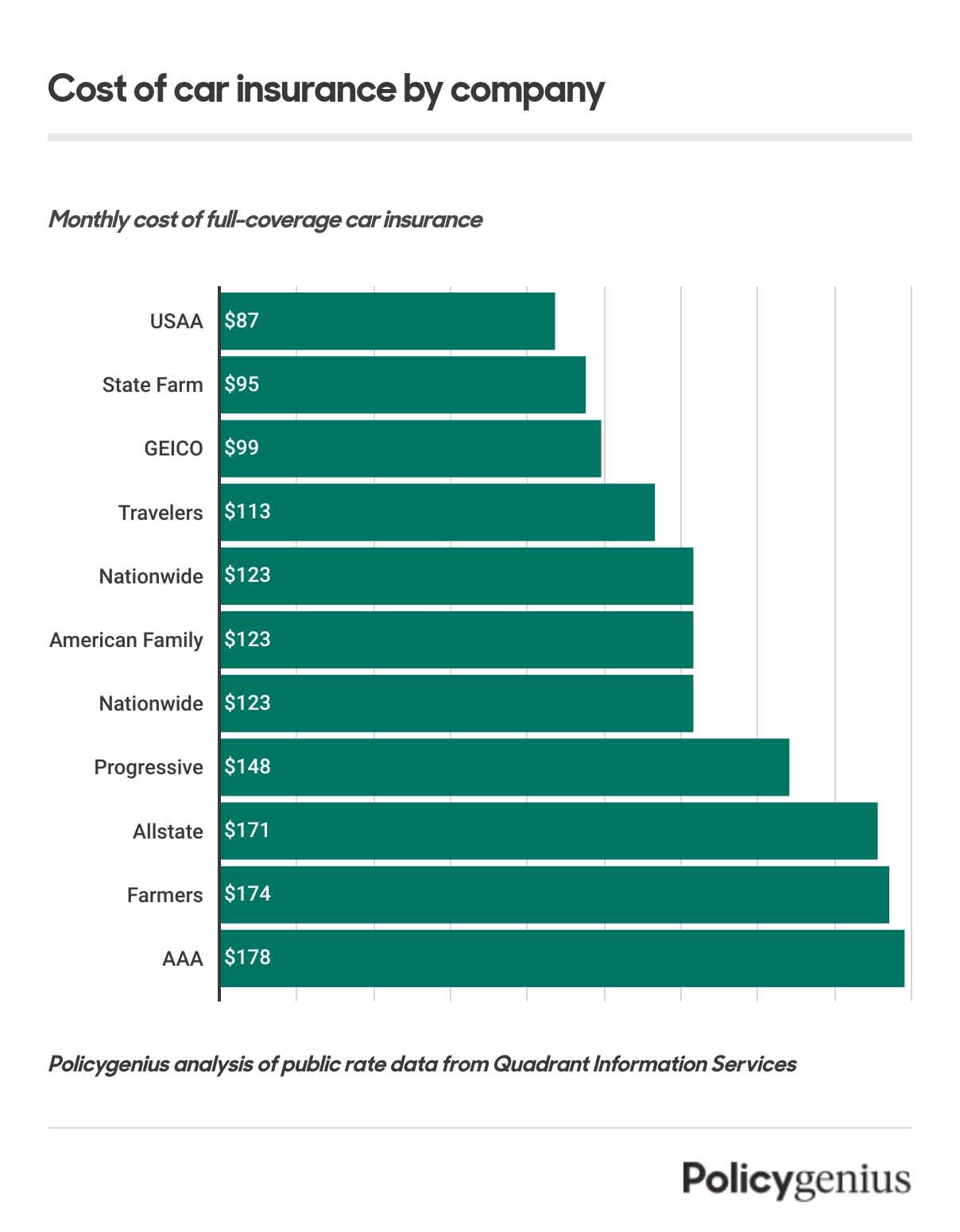

Credit: www.policygenius.com

Discounts And Savings Opportunities

Car insurance can be costly, but there are many discounts and savings opportunities available. These can help reduce your premiums significantly. Let’s explore some of the most common ways to save on car insurance.

Multi-policy Discounts

Many insurance companies offer discounts if you bundle multiple policies together. This is known as a multi-policy discount.

For example, you can save by combining your car insurance with:

- Home insurance

- Renters insurance

- Life insurance

Insurance companies often provide significant discounts for bundling. This can make managing your policies simpler and more cost-effective.

Usage-based Insurance

Another way to save is through usage-based insurance. This type of insurance bases your premium on your actual driving habits.

With usage-based insurance, your premium is influenced by:

- The number of miles you drive

- Your driving speed

- How often you drive

- Your braking habits

Many insurers use a device or app to track your driving. Safe and infrequent drivers often benefit the most from this type of policy.

Usage-based insurance can be a great option if you do not drive often or drive very safely.

How To Get Accurate Car Insurance Quotes

Getting accurate car insurance quotes can save you money and stress. Many factors affect car insurance rates. To get the best deal, you need accurate quotes. Here are some effective ways to achieve this.

Online Comparison Tools

Online comparison tools are a great starting point. These tools compare quotes from different insurers. Enter your information once, and see multiple quotes. This saves time and effort. Ensure the tool you use is reliable. Look for reviews and ratings. These tools often give instant results. You can compare and choose the best option quickly. Always review the coverage details carefully. Sometimes, the cheapest option may not offer the best coverage.

Working With An Agent

Working with an insurance agent can also help. Agents have in-depth knowledge of the market. They can provide personalized advice. An agent can explain the fine print. This helps you understand what you are buying. Agents can sometimes access special deals. These deals might not be available online. Make sure to choose a reputable agent. Check their credentials and reviews. An agent can help you find a plan that fits your needs and budget.

Long-term Strategies To Lower Costs

Car insurance is a necessary expense, but there are ways to lower the costs over time. Long-term strategies can help you save money on car insurance. Implementing these strategies requires planning and commitment. Below are two effective methods to reduce your car insurance costs over the long term.

Choosing The Right Coverage

Selecting the correct coverage is vital for managing insurance costs. Not everyone needs the highest level of coverage. Consider your car’s age and condition. Older cars may only need liability coverage.

- Review your policy annually.

- Adjust coverage based on the car’s value.

- Consider dropping comprehensive or collision coverage for older cars.

Also, check for discounts. Many insurers offer discounts for safe drivers, students, and more. Combining home and auto insurance can also save money.

Maintaining A Clean Record

A clean driving record significantly reduces insurance costs. Avoid accidents and traffic violations. Safe driving keeps your premium low.

- Follow traffic laws.

- Attend defensive driving courses.

- Avoid distracted driving.

Insurance companies reward safe drivers. Maintaining a clean record can lead to substantial savings.

In conclusion, choosing the right coverage and maintaining a clean record are effective long-term strategies to lower car insurance costs. Implement these strategies and enjoy the savings.

Credit: www.candsins.com

Frequently Asked Questions

What Factors Affect Car Insurance Costs?

Car insurance costs depend on several factors. These include age, driving history, vehicle type, and location. Your coverage level and deductible choice also impact the price.

How Can I Lower My Car Insurance Rates?

To lower car insurance rates, maintain a clean driving record. Opt for higher deductibles and bundle policies. Ask about discounts for safety features and low mileage.

Why Do Young Drivers Pay More For Car Insurance?

Young drivers pay more due to their lack of experience. Statistically, they are more likely to be involved in accidents. This increases risk for insurers.

Is It Cheaper To Pay Car Insurance Annually?

Paying car insurance annually can be cheaper. Insurers often offer discounts for annual payments. It also helps avoid monthly service fees.

Conclusion

Understanding car insurance costs helps you make smart decisions. Prices vary due to many factors. Age, location, and vehicle type all play roles. Compare quotes from various providers. Always look for discounts. Choose the best coverage for your needs. This ensures peace of mind while driving.

Save money and stay protected on the road.